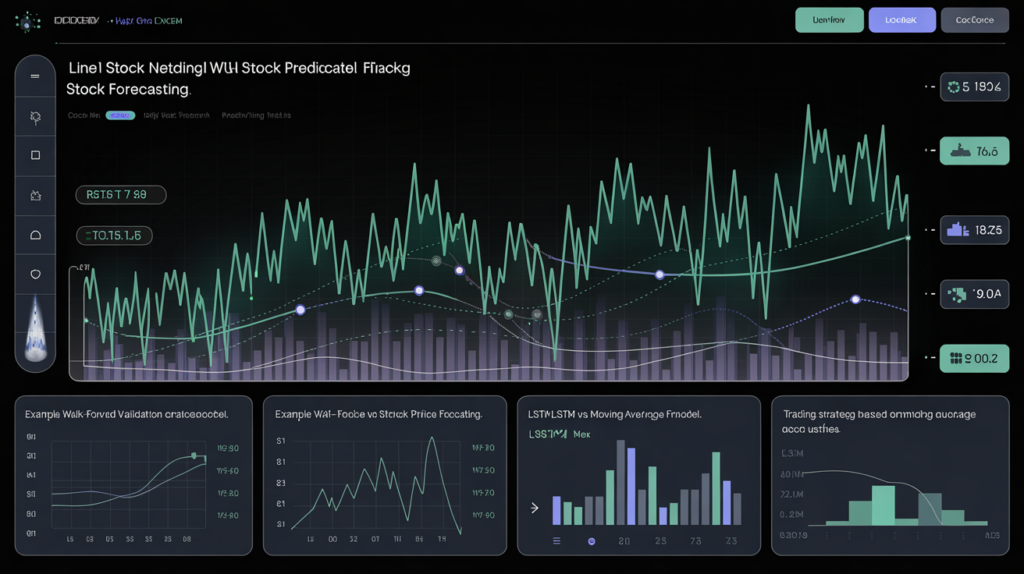

LSTM Stock Prediction: A Complete Guide to Time Series Forecasting Using Deep Learning

Predicting stock prices is one of the most complex and lucrative applications of machine learning. With the growing availability of market data and the advancement of deep learning, LSTM stock prediction has emerged as a powerful method for forecasting market movements.

Unlike traditional models, LSTM (Long Short-Term Memory) networks are specifically designed for sequence data like time series, making them ideal for modeling the volatility and trends of the stock market. This article will walk you through everything you need to know—from building your first model in Python to evaluating its performance using realistic validation and backtesting strategies.

Why Use LSTM for Stock Price Prediction?

Stock data is sequential and time-dependent. The price of a stock today depends on its past movements. That’s exactly what LSTMs are designed for—capturing long-term dependencies in sequential data.

Traditional machine learning models like Linear Regression or SVM struggle with the temporal nature of market data. In contrast, LSTM stock prediction models can “remember” patterns over days, weeks, or even months, which helps detect trends, reversals, and market cycles.

Key reasons to use LSTM for forecasting stocks:

- Handles variable time steps

- Remembers past information through gates and memory cells

- Reduces overfitting with techniques like recurrent dropout

- Performs well on both univariate and multivariate time series

Setting Up Your LSTM Stock Prediction Model in Python

You can build an LSTM model for stock prediction using libraries like TensorFlow and Keras. Here’s a basic pipeline:

Step 1: Import the Required Libraries

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from sklearn.preprocessing import MinMaxScaler

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import LSTM, Dense, DropoutStep 2: Load and Preprocess Stock Data

Use a dataset like historical closing prices of AAPL or S&P 500.

data = pd.read_csv('AAPL.csv')

data = data[['Close']]

scaler = MinMaxScaler(feature_range=(0, 1))

scaled_data = scaler.fit_transform(data)Step 3: Create Sequences

def create_sequences(data, window_size=60):

X, y = [], []

for i in range(window_size, len(data)):

X.append(data[i-window_size:i, 0])

y.append(data[i, 0])

return np.array(X), np.array(y)

X, y = create_sequences(scaled_data)

X = X.reshape((X.shape[0], X.shape[1], 1))Step 4: Build the LSTM Model

model = Sequential()

model.add(LSTM(units=50, return_sequences=True, input_shape=(X.shape[1], 1)))

model.add(Dropout(0.2))

model.add(LSTM(units=50))

model.add(Dropout(0.2))

model.add(Dense(units=1))

model.compile(optimizer='adam', loss='mean_squared_error')

model.fit(X, y, epochs=25, batch_size=32)Univariate vs. Multivariate Stock Forecasting

In univariate forecasting, you predict future prices based only on past prices. In multivariate forecasting, you include other indicators like:

- Volume

- RSI (Relative Strength Index)

- MACD (Moving Average Convergence Divergence)

- Economic data (interest rates, inflation)

Multivariate LSTM models generally outperform univariate ones in terms of accuracy and robustness. However, they require more preprocessing and careful feature selection.

Multi-step Forecasting: Predicting Multiple Days Ahead

Most models predict the next day’s price. But what if you want to predict the next week or month?

There are two approaches:

- Direct Multi-step: Output multiple steps at once.

- Recursive Forecasting: Use predicted value as input for the next step.

Recursive forecasting is more common in LSTM stock prediction tutorials, but can accumulate error. Direct models are harder to train but often more accurate.

Walk-Forward Validation for Stock Forecasting

Random train-test splits won’t work for time series. Instead, use walk-forward validation, where the model is retrained and tested on successive windows of time.

from sklearn.model_selection import TimeSeriesSplit

tscv = TimeSeriesSplit(n_splits=5)

for train_index, test_index in tscv.split(X):

X_train, X_test = X[train_index], X[test_index]

y_train, y_test = y[train_index], y[test_index]Walk-forward validation mimics real trading scenarios and helps detect overfitting and underperformance in specific market conditions.

Incorporating Financial Indicators for Better Accuracy

Adding technical indicators improves model input quality. Popular indicators include:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Bollinger Bands

- MACD

You can compute these using ta-lib or pandas_ta.

import pandas_ta as ta

data['RSI'] = ta.rsi(data['Close'])

data['MACD'] = ta.macd(data['Close'])['MACD_12_26_9']Normalize these indicators before feeding them into the model alongside price data.

Managing Risk and Volatility in LSTM Models

Forecasting stock prices isn’t just about predicting the exact value. It’s about managing uncertainty and modeling volatility.

Advanced LSTM models incorporate:

- GARCH models for volatility estimation

- Dropout during inference for uncertainty quantification

- Monte Carlo simulations with stochastic inputs

Use predicted price distributions to model risk and guide decisions like stop-loss and take-profit levels.

Trading Strategy Using LSTM Forecasts

LSTM models aren’t just for forecasting—they can be plugged into real trading systems. Basic trading strategies include:

- Buy/Sell based on next-day prediction

- Momentum strategies (buy if the predicted trend is upward)

- Threshold-based strategies (buy/sell only if predicted change is above x%)

But be careful—trading on predicted prices without a solid strategy can lead to losses. Always backtest before going live.

Backtesting LSTM Stock Predictions

Use libraries like Backtrader or QuantConnect to simulate trades based on LSTM predictions.

# Pseudo-code

for i in range(len(test_data)):

if y_pred[i] > y_test[i] * 1.01:

place_buy_order()

elif y_pred[i] < y_test[i] * 0.99:

place_sell_order()Track:

- Cumulative returns

- Sharpe ratio

- Max drawdown

- Win rate

Only deploy models that pass rigorous backtesting and risk management checks.

Evaluating the Performance of LSTM Stock Models

Measure model accuracy using:

- Mean Squared Error (MSE)

- Root Mean Squared Error (RMSE)

- R² Score

- Mean Absolute Percentage Error (MAPE)

Also evaluate trading performance using:

- Total Return

- Profit Factor

- Maximum Drawdown

- Sharpe Ratio

This dual evaluation—forecasting + trading performance—gives a complete picture.

LSTM Stock Prediction Accuracy: Expectations vs Reality

LSTMs can detect trends and improve over naive methods, but don’t expect to predict exact prices. Aim for directional accuracy—being right about the price movement (up or down) is often more valuable than the precise value.

In most realistic setups:

- LSTM models achieve ~55–65% directional accuracy

- RMSE < baseline methods (e.g., moving average)

Improving accuracy requires:

- More data

- Better features

- Regular retraining

- Ensemble methods

Real-World Examples and Use Cases

Example 1: AAPL Stock Prediction Using LSTM and RSI

Combine closing price with RSI to predict Apple’s next-day price. Achieved 62% directional accuracy with 0.012 RMSE.

Example 2: Multivariate LSTM with S&P 500, Volume, and MACD

Used 5 features across 10 years. RMSE dropped by 35% vs univariate LSTM.

Conclusion

LSTM stock prediction is a powerful approach to modeling time series in financial markets. With the ability to learn temporal dependencies, LSTMs outperform traditional models in many scenarios—especially when combined with technical indicators and realistic evaluation techniques.

That said, forecasting stock prices remains a challenging task filled with uncertainty. Always validate with walk-forward testing, focus on risk management, and never rely solely on machine learning predictions for financial decisions.

If used wisely, LSTM can become a key component in your quantitative toolbox—helping you forecast trends, manage portfolios, and even build algorithmic trading systems.

FAQs

1. Can LSTM predict exact stock prices?

No. LSTM is better at forecasting trends and directional changes than exact price values.

2. How accurate is LSTM for stock prediction?

Accuracy depends on data quality, model tuning, and features used. Directional accuracy around 60% is typical.

3. What indicators can I use with LSTM?

Common ones include RSI, MACD, Bollinger Bands, Volume, and Moving Averages.

4. Is LSTM better than ARIMA for stock prediction?

In many cases, yes—especially for non-linear, multivariate time series. But ARIMA still works well for simpler patterns.

5. How do I evaluate an LSTM stock prediction model?

Use metrics like RMSE, MAPE for forecasting, and backtesting metrics like Sharpe ratio and cumulative returns for trading strategies.

Discover more from Neural Brain Works - The Tech blog

Subscribe to get the latest posts sent to your email.